The tech landscape is evolving at breakneck speed, and the next five years (2025–2030) promise transformative advancements that will reshape how we live, work, and connect. From artificial intelligence to quantum computing, here are the top tech trends to watch, based on current developments and expert insights.

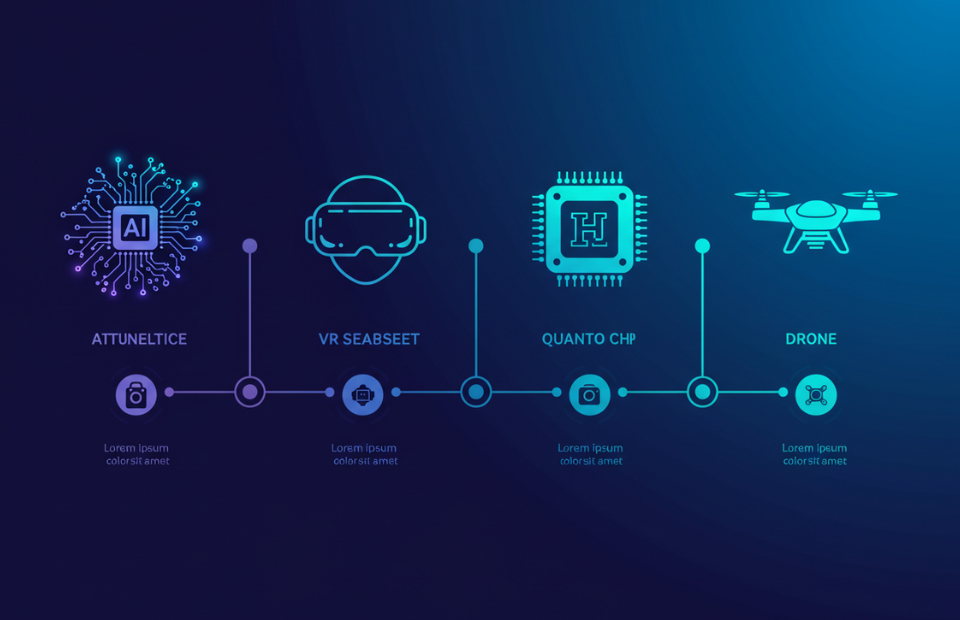

1. AI Becomes Ubiquitous and Ethical

Artificial Intelligence (AI) is already integral to daily life, but by 2030, it will be deeply embedded in nearly every industry.

- Advancements: AI will power hyper-personalized experiences, from tailored healthcare plans to adaptive learning platforms. Generative AI, like advanced versions of today’s models, will create everything from videos to legal documents with minimal human input.

- Ethical Focus: Regulations like the EU’s AI Act (2025) will drive transparency, with companies prioritizing bias-free algorithms and data privacy. Expect AI “trust scores” to become standard for consumer confidence.

- Impact: By 2030, AI is projected to contribute $15.7 trillion to the global economy, with 60% of jobs incorporating AI-driven tasks (PwC, 2024).

What to Watch: Look for AI assistants with emotional intelligence, capable of detecting user mood, and stricter global AI governance frameworks.

2. Quantum Computing Goes Mainstream

Quantum computing, once a lab experiment, is nearing commercial viability.

- Breakthroughs: Companies like IBM and Google aim to deliver practical quantum computers by 2029, solving complex problems in cryptography, drug discovery, and climate modeling.

- Applications: Quantum systems will optimize supply chains, crack encryption, and accelerate AI training, far surpassing classical computers.

- Challenges: High costs and error rates remain hurdles, but hybrid quantum-classical systems will bridge the gap for businesses.

What to Watch: Monitor IBM’s Quantum System Three (expected 2027) and Google’s progress toward “quantum advantage” in real-world use cases.

3. Extended Reality (XR) Redefines Interaction

Extended Reality (XR), encompassing virtual reality (VR), augmented reality (AR), and mixed reality (MR), will blur digital and physical worlds.

- Immersive Workspaces: By 2030, XR headsets like Apple’s Vision Pro 2 (rumored for 2026) will replace traditional monitors for remote work and gaming.

- Education and Training: AR will transform classrooms with interactive 3D models, while VR will simulate high-risk training (e.g., surgery or aviation).

- Market Growth: The XR market is expected to hit $250 billion by 2028, driven by lightweight, affordable headsets (Statista, 2025).

What to Watch: Expect Meta’s Orion AR glasses and Sony’s next-gen PSVR to set new standards for immersive experiences.

4. Sustainable Tech Gains Momentum

As climate concerns intensify, sustainable tech will dominate innovation.

- Green Computing: Energy-efficient data centers and biodegradable electronics will reduce tech’s carbon footprint. Google and Microsoft aim for carbon neutrality by 2030.

- Circular Economy: Modular devices (e.g., Fairphone 6, expected 2026) and e-waste recycling programs will extend product lifecycles.

- Renewable Integration: AI-driven smart grids will optimize energy use, with solar and wind powering 50% of global tech infrastructure by 2030 (IEA, 2024).

What to Watch: Look for advancements in solid-state batteries and carbon capture tech integrated into consumer devices.

5. 6G and Hyper-Connectivity

While 5G is still rolling out, 6G is already on the horizon, promising unprecedented connectivity by 2030.

- Speed and Latency: 6G will offer speeds up to 100 times faster than 5G, with near-zero latency, enabling real-time holographic communication and autonomous vehicle networks.

- Applications: Smart cities will use 6G for traffic management, while IoT devices (e.g., smart appliances) will connect seamlessly.

- Challenges: Infrastructure costs and global standardization remain barriers, with initial rollouts expected in urban areas by 2028.

What to Watch: Track trials by Nokia and Ericsson, with early 6G deployments in Asia (South Korea, Japan) by 2029.

6. Health Tech Revolution

Health tech will leverage AI, wearables, and biotech for personalized care.

- Non-Invasive Monitoring: Smartwatches like the Apple Watch Series 12 (expected 2026) may introduce non-invasive glucose monitoring and early cancer detection.

- Telehealth 2.0: AI-driven diagnostics and virtual reality therapy sessions will make healthcare accessible globally.

- Gene Editing: CRISPR-based treatments will target genetic diseases, with FDA approvals expected for more conditions by 2030.

What to Watch: Monitor Fitbit’s integration with Google’s Health Connect and advancements in mRNA-based therapies.

7. Decentralized Web and Blockchain

Web3 and blockchain will redefine digital ownership and security.

- Decentralized Platforms: Blockchain-based social networks and marketplaces will give users control over data, reducing reliance on tech giants.

- Digital Identity: Self-sovereign IDs will secure online transactions and protect privacy by 2030.

- NFT Evolution: Beyond art, NFTs will authenticate digital assets, from virtual real estate to academic credentials.

What to Watch: Ethereum’s scalability upgrades and Solana’s adoption in mainstream finance will drive Web3 growth.

8. Autonomous Systems Expand

Autonomous technology will extend beyond cars to everyday applications.

- Self-Driving Vehicles: Level 5 autonomy (fully driverless) is expected in urban areas by 2030, led by Tesla and Waymo.

- Drones and Robotics: Delivery drones and home assistant robots will become commonplace, with Amazon’s drone program expanding by 2028.

- Safety Concerns: Regulatory frameworks will evolve to address liability and ethical issues.

What to Watch: Follow Waymo’s city expansions and Boston Dynamics’ consumer robotics developments.

Challenges to Anticipate

- Privacy and Ethics: Data misuse and AI bias will spark debates, requiring robust regulations.

- Digital Divide: Unequal access to tech could widen global inequalities, especially in rural areas.

- Job Disruption: Automation may displace 20% of current jobs by 2030, though new roles in AI and quantum tech will emerge (McKinsey, 2025).

How to Prepare

- Stay Informed: Follow tech blogs, podcasts (e.g., The Vergecast), or platforms like X for real-time updates.

- Upskill: Learn AI, blockchain, or XR basics via Coursera or edX to stay competitive.

- Adopt Early: Test emerging tools, like AI assistants or AR apps, to understand their potential.

Conclusion

The next five years will bring unprecedented tech advancements, from AI’s deeper integration to quantum computing’s real-world impact. By staying curious and adaptable, you can harness these trends to enhance your life and career. Keep an eye on industry leaders like Apple, Google, and emerging startups to see how these innovations unfold by 2030.